Key takeaways:

Ethereum’s base layer activity has cooled, with fees and TVL dropping, showing slower demand despite the recent price recovery.

Layer-2 networks are growing rapidly, helping to support Ethereum even as base layer usage weakens and traders remain cautious.

Ether (ETH) rallied to a three-week high near $3,400 on Tuesday after weak United States job market data reinforced expectations that US monetary policy could become less restrictive sooner than previously thought.

Even with the 11.2% weekly gains, traders still worry that sluggish Ethereum network activity and limited demand for bullish leverage may curb the short-term upside.

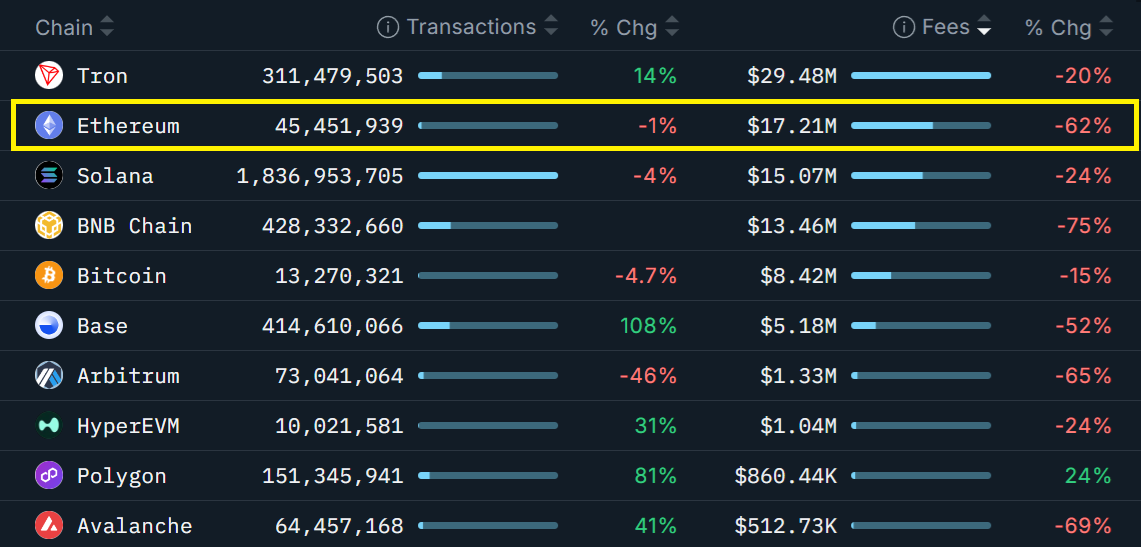

Nansen data shows that Ethereum’s 30-day network fees dropped by 62%, a far deeper pullback than the roughly 22% decline observed on Tron, Solana and HyperEVM during the same window.

Some activity, however, stood out: transactions on Base rose 108%, while Polygon recorded an 81% increase, suggesting continued momentum across Ethereum’s expanding layer-2 ecosystem.

The Ethereum Fusaka upgrade on Dec. 3 introduced changes designed to improve rollup efficiency, which may have contributed to the lower network fees noted throughout the month.

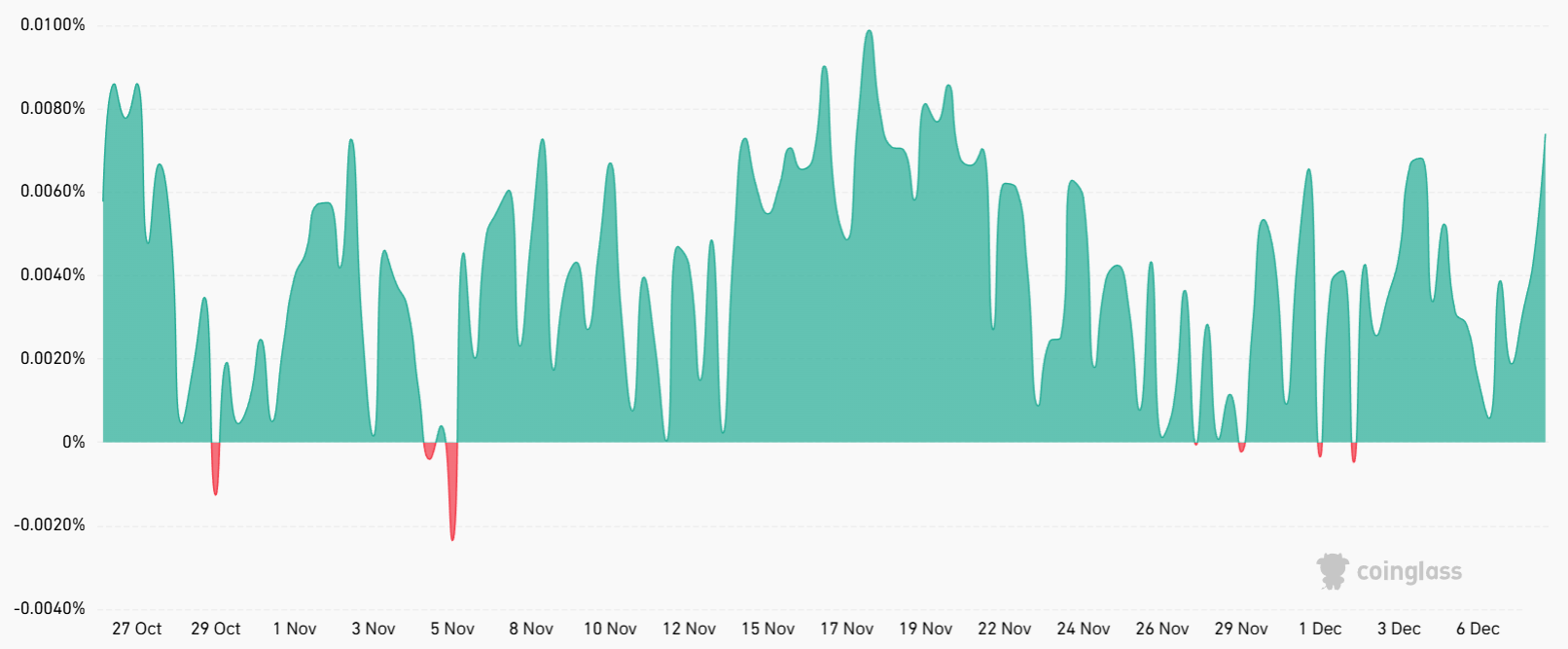

On Tuesday, the annualized funding rate for ETH perpetual futures held near 9%, reflecting a fairly even distribution of leveraged positions between buyers (longs) and sellers (shorts). Under normal market conditions, this indicator tends to oscillate between 6% and 12% to account for capital costs; levels above that range usually signal stronger bullish positioning.

Traders turned more defensive after the US Bureau of Labor Statistics reported 1.85 million layoffs in October, the highest figure since 2023. Markets are now pricing in a 0.25% interest rate cut by the US Federal Reserve on Wednesday, while attention shifts to Fed Chair Jerome Powell’s comments following the Committee meeting.

Ethereum’s layer-2 growth offsets base layer fee declines

Despite the recent bullish momentum, Ether still trades 32% below its all-time high of $4,597 from August. To gauge whether demand for the Ethereum network is genuinely declining, it’s useful to look at the impact on decentralized applications (DApps).

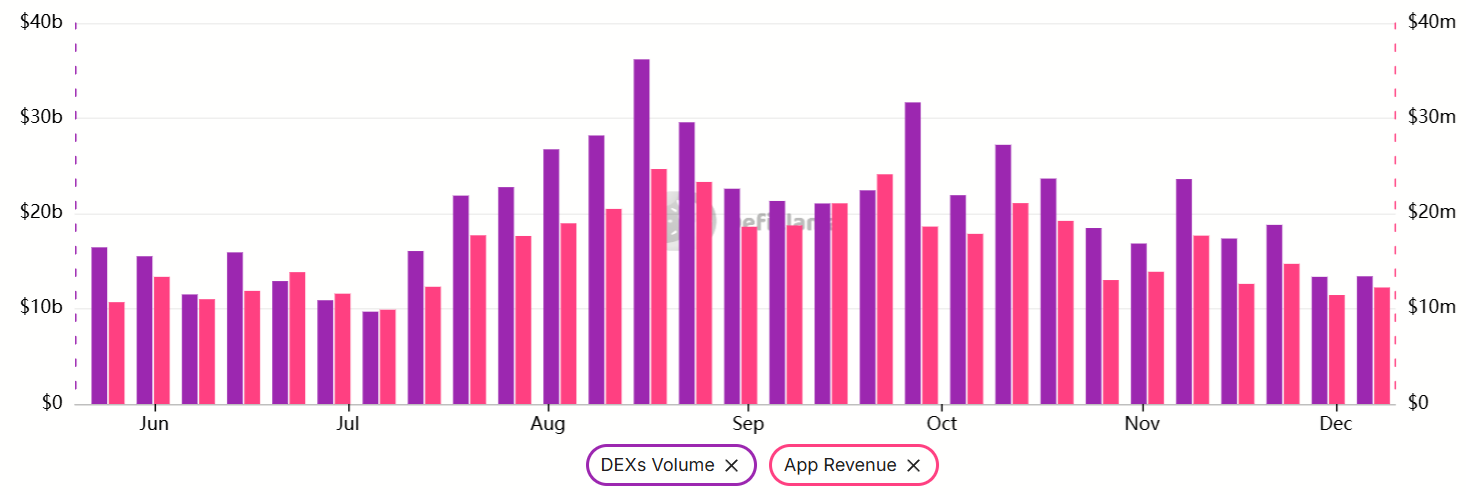

Volumes on Ethereum-based decentralized exchanges fell to $13.4 billion over seven days, down from $23.6 billion four weeks earlier. Likewise, decentralized application revenues reached a five-month low of $12.3 million during the same period. Overall, demand for Ethereum’s base layer processing has been slipping since it peaked in late August.

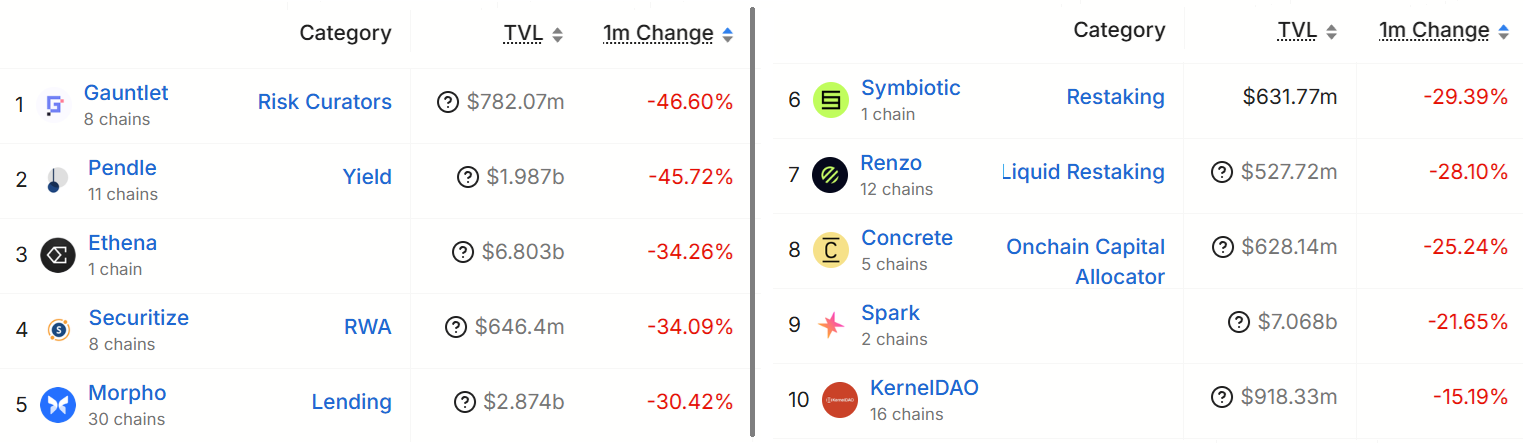

Some of Ethereum’s leading DApps saw a sharp drop in total value locked (TVL), including Pendle, Athena, Morpho and Spark. Aggregate TVL on the Ethereum base layer fell to $76 billion from $100 billion two months earlier. Even so, Ethereum’s dominance remains intact with a 68% market share, while runner-up Solana holds under 10%.

Ether bulls argue that the network’s strong incentives for layer-2 scalability offer a more sustainable model compared with the heavier load and centralized coordination required by competing blockchains. Ethereum is positioned to capture a significant share of future growth in decentralized finance (DeFi).

Related: US Treasurys lead tokenization wave as CoinShares predicts 2026 growth

US Securities and Exchange Commission Paul Atkins reportedly said in a FOX Business interview that tokenization of the US market could occur in “a couple of years,” adding that blockchain offers “huge benefits” such as predictability and transparency. Atkins said the US should “embrace this new technology, bring it onshore where it can work under American rules.”

While Ethereum’s base layer fees have seen a sharp decline, along with the drop in TVL, activity across the layer-2 ecosystem continues to expand. Currently, neither onchain nor derivatives data indicate a meaningful weakness in ETH price dynamics.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.